What Does Find MrCooper Home Mortgages in North Las Vegas, NV Mean?

The 4-Minute Rule for FHA Mortgages

Living in Nevada Whatever your interest, Nevada has something to provide, from hotspots like Las Vegas and Reno to the beautiful natural appeal of Lake Tahoe and Red Rock Canyon. Nevada newbie home purchaser programs Newbie home purchaser support programs in Nevada and throughout the U.S. deal loans, grants, down payment assistance and tax credits.

Contact your U.S. Bank home loan officer to learn more about programs offered in Nevada. Discover a mortgage officer in Nevada. Our local home loan officers understand the specifics of the Nevada market. Let us help you browse the home-buying procedure so you can focus on finding your dream home.

The Facts About Mortgages: Get Preapproved for a Home Loan - Navy Federal Revealed

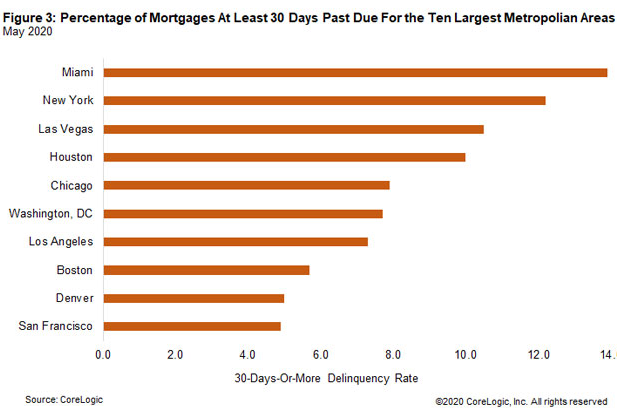

Nevada home mortgage summary, By Nevada is appealing to many homebuyers thanks to its year-round sunny climate, budget friendly cost of living and low taxes. The Silver State has two distinct real estate markets: In the northern part of the state, consisting of Reno and Stimulates, the mean price for single-family homes was $405,000 as of June 2020, according to the Reno/Sparks Association of Realtors.

Compare Today's Mortgage Rates in Nevada - SmartAsset

The median home price there was $315,000 as of May 2020, according to Las Vegas Realtors. First- https://www.bing.com/maps?osid=c56c556f-de0f-4175-bde0-b7b155d2e3ae&cp=36.027875~-115.107586&lvl=16&imgid=1986c706-388a-4cd1-aa8e-203c258ce0c8&v=2&sV=2&form=S00027 in Nevada, The Nevada Housing Department (NHD) has a range of programs to assist low- and moderate-income buyers purchase houses. House Is Possible program, First-time or repeat property buyers in Nevada can get up to 5 percent of the home mortgage value to use for the down payment or closing costs when getting a home loan through the Home Is Possible program.

Different Types of Mortgage Loans

Excitement About Guaranteed Rate: Mortgages, Loans, Home Buying

There is a $755 charge. The optimal house rate enabled is $510,400. If you're making an application for an FHA, USDA or VA loan, your earnings needs to be below $98,500 to qualify. For standard loans, you'll need to satisfy the earnings limits for your county. You'll also need a minimum credit report of 640.

Home Mortgage Rates NV - Home Loan Rates - Greater Nevada Mortgage

You do not require to be a novice property buyer, however you might not own other home, and the house must be a main residence. To certify, your earnings must be listed below $98,500, and the house rate should be listed below $510,400. The minimum credit history is 640 and there is a $755 charge.